Shoppers probably don't think much about what happens next when they place an online grocery order.

But it sets-off an intricate dance of software, artificial intelligence, robots, vans and workers. At an Ocado warehouse just outside Luton, I'm in the middle of such a dance.

As far as I can see, hundreds of robots whizz around a grid, fetching items for online orders. They move with dizzying speed and precision. In the early days of online shopping, when you placed an order, humans would dash around a warehouse or a store collecting your items.

But for years now, Ocado has been using robots to collect and distribute products, bringing them to staff, who pack them into boxes for delivery. And Ocado is not the only firm investing in such automation.

In its warehouses, Asda uses a system from Swiss automation firm Swisslog and Sweden's AutoStore. In the US, Walmart has been automating parts of its supply chain using robotics from an American company called Symbotic.

Back in Luton, Ocado has taken its automation process to a higher level. The robots which zoom around the grid, now bring items to robotic arms, which reach out and grab what they need for the customer's shop.

Bags of rice, boxes of tea, packets of crumpets are all grabbed by the arms using a suction cup on the end. It might seem like a trivial addition, but training a robot to recognise an item, grab it successfully and move it, is surprisingly difficult.

At Ocado around 100 engineers have spent years training the artificial intelligence (AI) to take on that task. James Matthews, chief executive of Ocado Technology explains the AI has to interpret the information coming from its cameras.

“What is an object? Where are the edges of that object? How would one grasp it?” In addition the AI has to work out how to move the arm. “How do I pick that up and accelerate in a way without flinging it across the room? How do I place it in a bag?” he says.

The Luton warehouse has robotic 44 arms, which at the moment account for 15% of the products that flow through the facility, that's about 400,000 items a week. The rest are handled by staff at picking stations.

The staff handle items that robots are not ready for yet, like wine bottles which are heavy and have curved surfaces, making them difficult to grasp. But the system is ramping up. The company is developing different attachments for the robot arms that will allow them to handle a wider variety of items.

“We're just playing it carefully and ramping slowly over time,” says Mr Matthews. “It's a deliberate constraint on our behalf, so we continue providing good service to people, and not crushed custard creams in every order, or worse, putting stuff on the track that goes under the wheels of one of the bots and creates an incident.”

In two or three years Ocado expects the robots will account for 70% of the products. This inevitably means fewer human staff, but the Luton warehouse still has 1,400 staff, and many of those will still be needed in the future.

“There will be some sort of curve that tends towards fewer people per building. But it's not as clear cut as, ‘hey, look, we're on the verge of just not needing people'. We're a very long way from that,” Mr Matthews says.

Ocado is hoping to sell its automation technology to companies outside the grocery sector. Late last year it announced a deal with Canada's McKesson, a large pharmaceuticals distributor.

“Think about which industries have the need to move things around efficiently inside of warehouse… it's endless,” says Mr Matthews.

So where will the automation of warehouses end? Are we heading to human-free warehouses that can run 24 hours a day?

Not so fast, says Sarah Bolton, who specialises in commercial real estate at law firm Taylor Wessing.

“It's almost prohibitively expensive, we're talking hundreds of millions of pounds to fully automate a warehouse,” she points out.

“So you're really only talking about the big tenants in the really big warehouses looking at full automation, just because you have to have that size to make it anywhere near financially viable.”

She also points that automation needs modern buildings, including floors that can stand heavy weights, large spaces without support columns, so there's less for the robots to crash into. Reliable electricity connections are also vital.

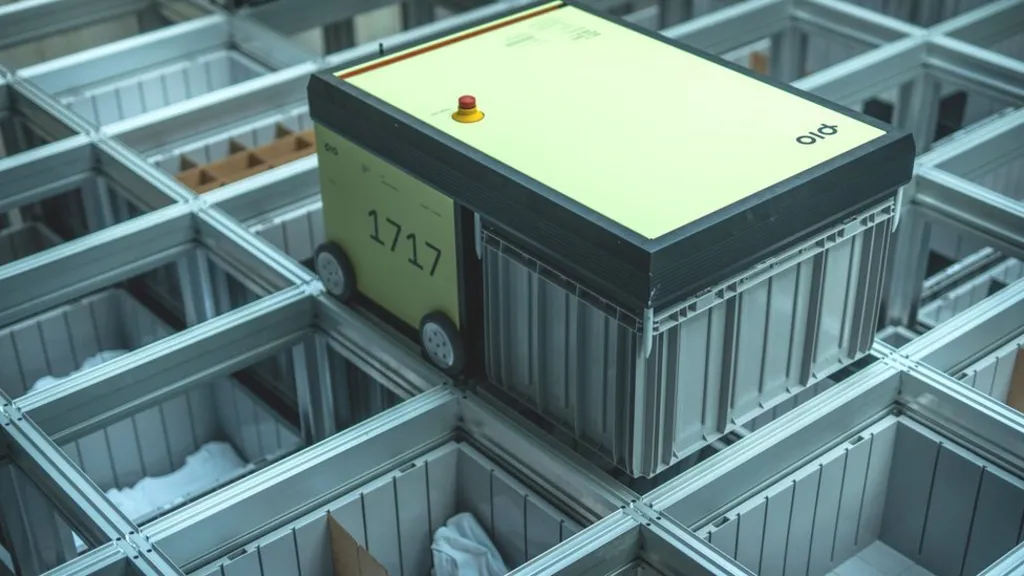

“You're reliant on new build, and there's a massive undersupply of new build warehouse stock in the UK at the minute,” says Ms Bolton. AutoStore is tackling some of those challenges. It has a company called Pio which is developing automation for smaller businesses.

It uses much of the same technology that AutoStore supplies to big firms – robots buzzing around on a storage grid where goods are stacked vertically.

However the upfront costs of Pio's system are lower, with the cost related to the volume of goods the system handles. The software is simpler and designed to integrate easily with common e-commerce systems like Shopify.

“It's a complete offering… where the upfront cost is very reduced. So it's quite affordable for these companies to get access to automation and start to get the benefits out of it. And since the technology is very flexible and scalable, you can continue to basically increase volume by adding more robots rather than more storage capacity,” says Carlos Fernández, chief product officer at AutoStore.

At the moment 10 clients are running Pio's automation system with another five customers signed up.

Mr Fernández sees huge growth potential.

“Over the coming years, there's going to be a journey of making the technology simpler and more affordable. It won't require you to be a large corporation to run complex automation projects, and you won't need to invest big amounts of capital also to start getting the benefits.”