Three decades on from the day it began, it is hard to get your head around the scale of Amazon.

Consider its vast warehouse in Dartford, on the outskirts of London. It has millions of stock items, with hundreds of thousands of them bought every day – and it takes two hours from the moment something is ordered, the company says, for it to be picked, packed and sent on its way.

Now, picture that scene and multiply it by 175. That's the number of “fulfilment centres”, as Amazon likes to call them, that it has around the world. Even if you think you can visualise that never-ending blur of parcels crisscrossing the globe, you need to remember something else: that's just a fraction of what Amazon does.

It is also a major streamer and media company (Amazon Prime Video); a market leader in home camera systems (Ring) and smart speakers (Alexa) and tablets and e-readers (Kindle); it hosts and supports vast swathes of the internet (Amazon Web Services); and much more besides.

“For a long time it has been called ‘The Everything Store', but I think, at this point, Amazon is sort of ‘The Everything Company',” Bloomberg's Amanda Mull tells me.

“It's so large and so omnipresent and touches so many different parts of life, that after a while, people sort of take Amazon's existence in all kinds of elements of daily life sort of as a given,” she says. Or, as the company itself once joked, pretty much the only way you could get though a day without enriching Amazon in some way was by “living in a cave”.

So the story of Amazon, since it was founded by Jeff Bezos in 1994, has been one of explosive growth, and continual reinvention. There has been plenty of criticism along the way too, over “severe” working conditions and how much tax it pays.

But the main question as it enters its fourth decade appears to be: once you are The Everything Company, what do you do next?

Or as Sucharita Kodali, who analyses Amazon for research firm Forrester, puts it: “What the heck is left?”

“Once you're at a half a trillion dollars in revenue, which they already are, how do you continue to grow at double digits year over year?”

One option is to try to tie the threads between existing businesses: the vast amounts of shopping data Amazon has for its Prime members might help it sell adverts on its streaming service, which – like its rivals – is increasingly turning to commercials for revenue.

But that only goes so far – what benefits can Kuiper, its satellite division, bring to Whole Foods, its supermarket chain?

To some extent, says Sucharita Kodali, the answer is to “keep taking swings” at new business ventures, and not worry if they fall flat.

Just this week Amazon killed a business robot line after only nine months – Ms Kodali says that it is just one of a “whole graveyard of bad ideas” the company tried and discarded in order to find the successful ones.

But, she says, Amazon may also have to focus on something else: the increasing attention of regulators, asking difficult questions like what does it do with our data, what environmental impact is it having, and is it simply too big?

All of these issues could prompt intervention “in the same way that we rolled back the monopolies that became behemoths in the early 20th century”, Ms Kodali says.

For Juozas Kaziukėnas, founder of e-commerce intelligence firm Marketplace Pulse, its size poses another problem: the places its Western customers live in simply can not take much more stuff.

“Our cities were not built for many more deliveries,” he tells the BBC. That makes emerging economies like India, Mexico and Brazil important. But, Mr Kaziukėnas, suggests, there Amazon does not just need to enter the market but to some extent to make it.

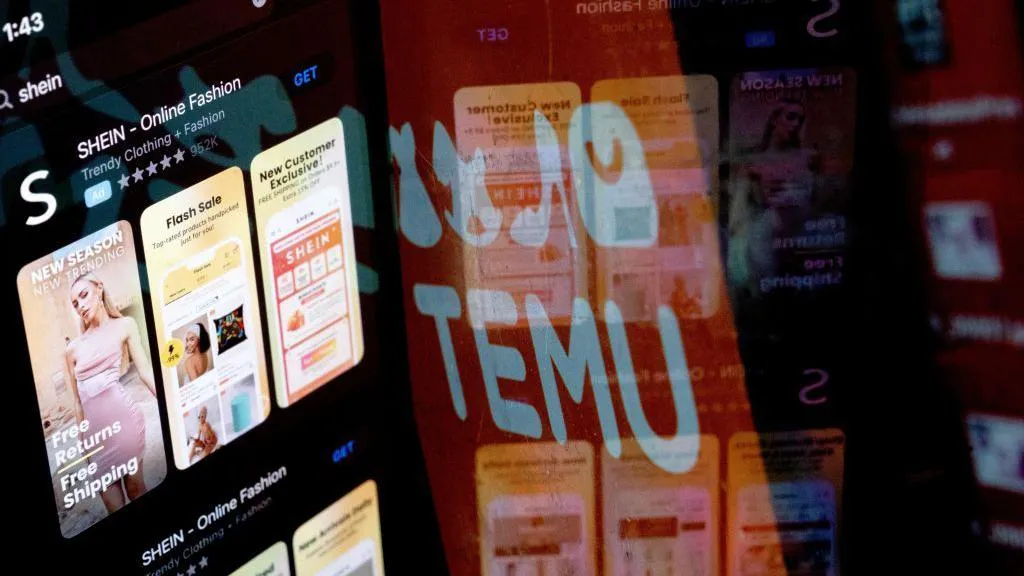

“It's crazy and maybe should not be the case – but that's a conversation for another day,” he says. Amanda Mull points to another priority for Amazon in the years ahead: staving off competition from Chinese rivals like Temu and Shein.

Amazon, she says, has “created the spending habits” of western consumers by acting as a trusted intermediary between them and Chinese manufacturers, and bolting on to that easy returns and lightening fast delivery.

But remove that last element of the deal and you can bring prices down, as the Chinese retailers have done.

“They have said ‘well, if you wait a week or 10 days for something that you're just buying on a lark, we can give it to you for almost nothing,'” says Ms Mull – a proposition that is appealing to many people, especially during a cost of living crisis.

Juozas Kaziukėnas is not so sure – suggesting the new retailers will remain “niche”, and it will take something much more fundamental to challenge Amazon's position.

“For as long as going shopping involves going to a search bar – Amazon has nailed that,” he says. Thirty years ago a fledging company spotted emerging trends around internet use and realised how it could upend first retail, then much else besides.

Mr Kaziukėnas says for that to happen again will take a similar leap of imagination, perhaps around AI.

“The only threat to Amazon is something that doesn't look like Amazon,” he says.

— CutC by bbc.com