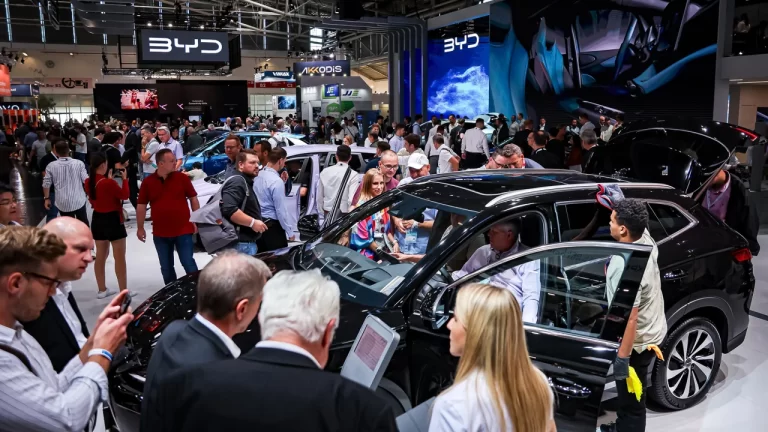

Chinese makers of electric vehicles have come out in force for this week’s IAA Mobility auto show in Munich, Germany.

About 50 companies — including heavyweight BYD and upstarts like Xpeng — have traveled to the city, according to China’s state media, about twice as many as the last time the event was held and the largest-ever Chinese delegation at any global car expo. And they were the talk of the town. Even before the show kicked off, Renault chief executive Luca de Meo was on French radio talking up the rapid advances made by Chinese EV makers.

“It’s clear that they are very competitive in the electric car value chain. I think they are a generation ahead of us,” de Meo told RTL Radio Monday. “We need to catch up very, very quickly.” Chinese electric cars, cheaper than models built elsewhere, are making inroads in Europe, Australia and Southeast Asia. Competitors worry that Chinese brands may eventually dominate the global EV market.

China surpassed Japan to become the world’s largest auto exporter in the first quarter of this year, driven by strong demand from Russia and a growing global appetite for EVs, according to a post on the website of the China Association of Automobile Manufacturers.

In the first eight months of the year, passenger car exports surged 72% to 2.3 million vehicles, a quarter of which were electric, according to data released Friday by the China Passenger Car Association. In August alone, EV market leader BYD exported more than 25,000 vehicles, followed by Tesla China’s 19,465 units.

In Europe, the top destination for China’s car exports, sales of Chinese EVs are booming. Chinese companies exported nearly 350,000 EVs to nine European countries in the first half of the year, more than they exported in all of 2022, according to data from the China Passenger Car Association. And in the last five years, European Union imports of Chinese cars have quadrupled.

By 2030, Chinese carmakers could see their share of the global market double from 17% to 33%, with European firms suffering the biggest loss of market share, according to a recent estimate by UBS.

Looking to Europe

Auto analysts say a handful of Chinese EV makers are emerging as “new global champions.”

“Overcapacity, economic slowdown, and the highly competitive automotive market at home are making Chinese [carmakers] look overseas for sales,” said Dylan Khoo, an EV industry analyst at New York-based ABI Research. “In Europe, they see a lucrative market with a great demand for EVs and few protectionist measures.”

Chinese manufacturers pay a 10% import duty to send their vehicles to the EU, compared with 27.5% required by the United States. Aside from the low tax, what makes Europe attractive is the bloc’s decision to ban the sale of new internal combustion engine cars by 2035.

Almost all Chinese automakers plan to focus on major European markets, such as Germany and France, in the next three to five years, according to a Deloitte report published late last year. Seventy-five percent of companies surveyed by the consultancy also intended to enter the North American market.

And 88% of respondents planned to export mainly EVs.

BYD, China’s largest EV manufacturer, aims to double the number of its dealer partners in Europe to 200 this year, Li Yunfei, a BYD spokesman, told reporters in Munich Tuesday. The company plans to increase its overall overseas sales to 250,000 vehicles in 2023, compared with 55,916 in 2022.

Xpeng, for its part, launched new models at the show and announced it would enter the German market in 2024. It also plans to increase the number of both its sales and service centers in Europe by the end of this year.

BMW CEO Oliver Zipse said Sunday that, as a consequence of the upcoming EU ban on conventional vehicles and growing competition from Chinese automakers, European mass-market carmakers might exit the production of mass-market cars after the ban comes into effect, due to profitability concerns.

EVs, which will become the only option for European manufacturers from 2035, tend to be more expensive to produce than their gasoline or diesel peers. According to Khoo at ABI Research, “Chinese disruptors” offer European customers competitively priced EVs and high quality across different price segments.

“The European automotive supply chain will be disrupted from two directions: These Chinese brands pushing into Europe, and Western [carmakers] building production capacity in China for export to Europe,” he added.

Chinese cars are also gaining popularity in other parts of the world. In the first half of 2023, sales of Chinese cars in Australia, including EVs, nearly doubled from a year ago, reaching a market share of more than 16%.

Much cheaper

The trump card for Chinese EVs might be their cost advantage. Chinese autos are roughly 30% cheaper than their European and US equivalents, according to research firm Jato Dynamics. The average price of an EV in China was €31,829 ($34,096) in the first half of 2022, compared with €55,821 ($59,797) in Europe and €63,864 ($68,429) in the United States, the firm said in a report last year.

“Much of China’s success in driving widespread EV uptake has been attributed to the industry’s ability to produce affordable entry-level vehicles for the masses,” the researchers wrote. Consumers’ perceptions are also changing that Chinese manufacturers made lower quality cars, they added.

MG, a former British carmaker now controlled by China’s SAIC, registered record sales in the United Kingdom in the first quarter of this year. It’s now the second best-selling EV in the country, according to the company.

In Europe and the United States, many car buyers looking for entry-level models are priced out of the new car market and instead look to buy second-hand vehicles, delay their purchases or simply use alternative modes of transport, they said.

But in China, with widespread demand, strong government incentives and rapidly developing new technologies, EVs have become the norm.

“China’s focus has been to ensure that EVs were accessible for the masses, and it has done so to great success,” the Jato Dynamics researchers said. By contrast, EV manufacturers across Europe and the United States, which are mature car markets with limited government support, have been unable to produce these vehicles “at such a pace,” they added.

Supply chain advantage

A major factor contributing to the lower cost of Chinese EVs is the country’s dominance of the EV battery supply chain. According to data from South Korean consulting firm SNE Research, Chinese manufacturers’ share of the global EV battery market stood at 60% in 2022.

The country also controls the production of battery materials, including nickel, cobalt and lithium.

“China’s competitive advantage in lithium-ion battery cell production gives its carmakers an edge in terms of EV production costs,” Moody’s analysts said in a report last month. China is estimated to account for more than half of global supply of lithium, with that advantage compounded by its lower labor costs, they added.

However, geopolitical tensions could complicate Chinese EV firms’ global push.

“Increasingly, the US and Europe are looking to ‘de-risk’ from China, which could create barriers to Chinese imports, even if production costs are lower,” Moody’s analysts said. “This could see China’s current acceleration in the auto export race run out of puff.”

— CutC by cnn.com